Employers and employees, brace yourselves.

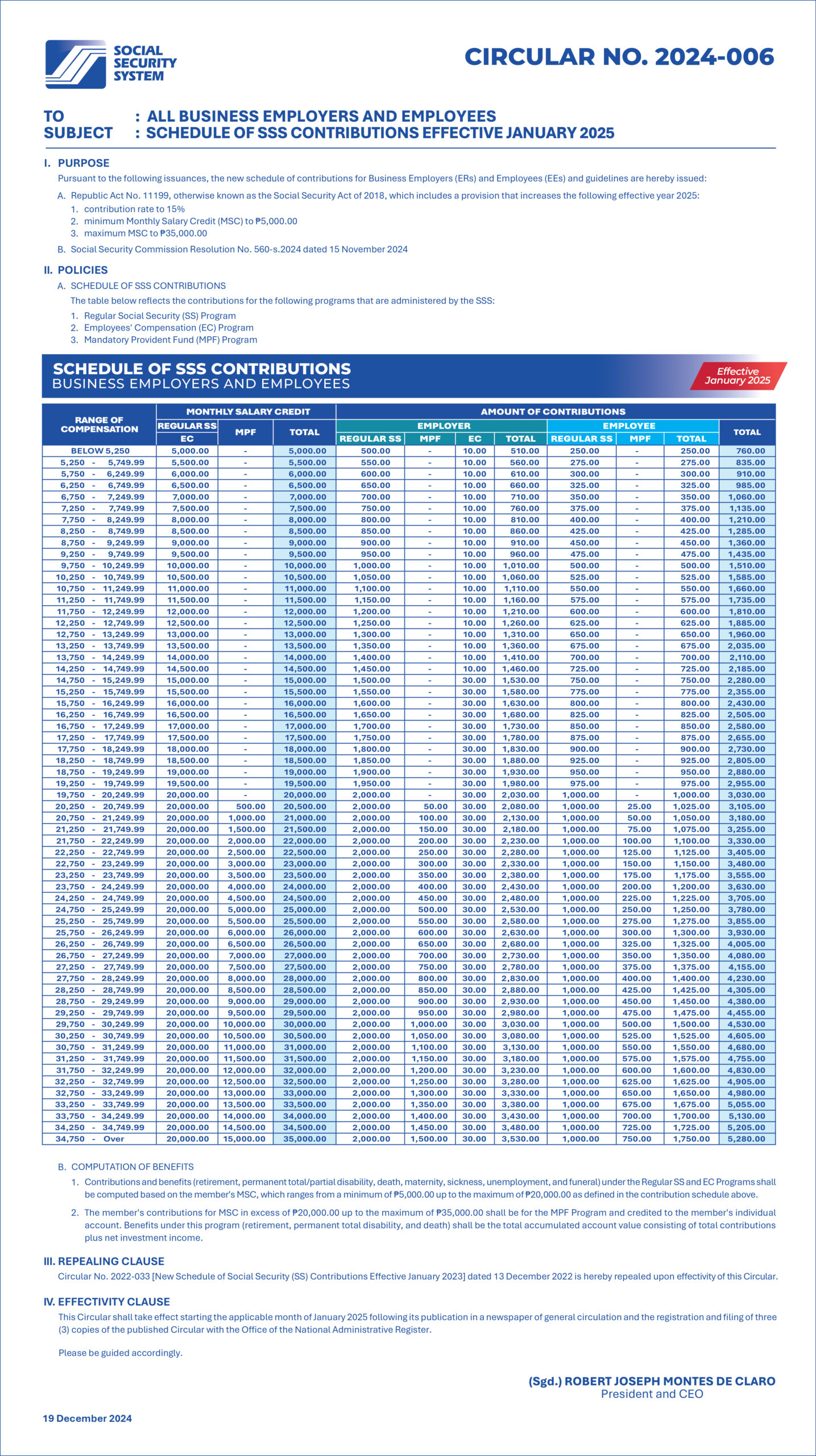

There will be an increase in SSS Contribution Rate for Employers and Members, to 15% starting January 2025. This is pursuant to Republic Act No. 11199, or Social Security Act of 2018. This is the last tranche for the increase, which started from 12% in 2019 to 15% in 2025.

This means that employees will to shoulder more contributions from their salary, meaning lower take home pay. For the Employers, the burden is heavier since their contribution is twice that of the Employees.

Highest monthly Salary Credit is PHP 35,000.00 (from PHP 30,000.00), highest employee contribution is PHP 1750, and highest overall remittance is PHP 5280.

Please see link for full table:

Leave a comment